We offer fast business funding services

We work quickly to get you business funding while you remain focused on your business.

Business Line of Credit

$5K - 100K

A business line of credit is an excellent way for businesses to have the funds they need when they need them the most. With a line of credit, businesses can borrow money up to an approved limit and only pay interest on the amount they draw.

Key Benefits:

Simply Online Application

Quick Approval within One Business Day

Flexible Repayment Terms

Small Business Funding

Quick Funding Up-To $2MM

Small business funding can be a difficult thing to come by, especially when banks say no. That’s where we come in. We work with various lenders to help you find the best offer for your business needs.

Key Benefits:

No Collateral Needed

Fast Online Application Process

Receive a Decision In One Business Day

Cash Advance for Business

Same Day Funding

Up-To $25K

With a Quick Cash Advance for Business, self-employed gig – workers, freelancers, and more can get the cash you need to grow your business quickly and easily. You can receive the funds the same business day and repay the advance through automated debits from your business or personal checking account.

Key Benefits:

Use for Any Purpose

No Credit Check Up-To $5,000

Easy Online Application

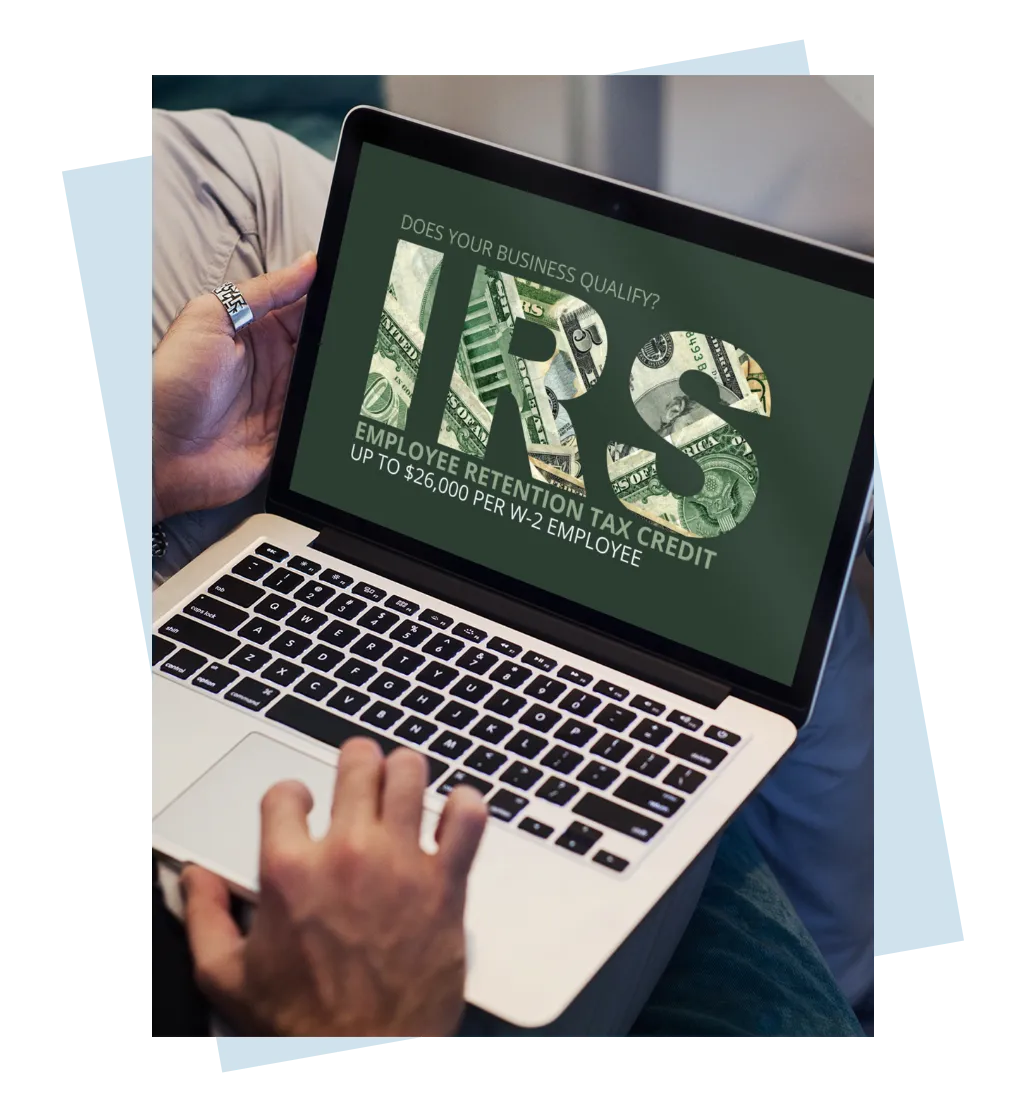

Employee Retention Tax Credit Up - To $26K Per W2 Employee

The Employee Retention Tax Credit is a refundable payroll tax credit for eligible employers that retain their employees during the COVID-19 pandemic. You may still qualify for up to $26,000 per employee if you have yet to apply for ERTC, even if you have received P.P. P. Let our partner licensed CPAs determine your eligibility today at no upfront cost.

Key Benefits:

Determine Your Eligibility At No cost.

Easy Online Application Process

Get help from Licensed CPAs to Ensure You Get Back the Maximum ERTC.

Schedule your free 1-on-1 consultation

Our team will help you determine how to secure business funding for your company's growth. After the talk, you will feel more encouraged about the future of your business.

About our company

We’re a small business ourselves, and we know the importance of getting the working capital you need to grow. That’s why we offer business funding based on your revenue, not your credit score.

So whether you’re just starting out or you’ve been in business for years, we can help.

© 2022- 2023 Small Business Working Capital. All Rights Reserved.